July 11, 2020

I’ve got to quit watching the news. It’s making me crazy. I try not to get political here but what’s going on in our country today has got me all hot and bothered. It’s like someone pulled back the curtain on all our institutions and revealed how inept and cowardly our so called leaders are. Where’s the Wizard of Oz when you need him? We’ve got some people running the show who are in desperate need of some brains and courage.

Broader Market Review

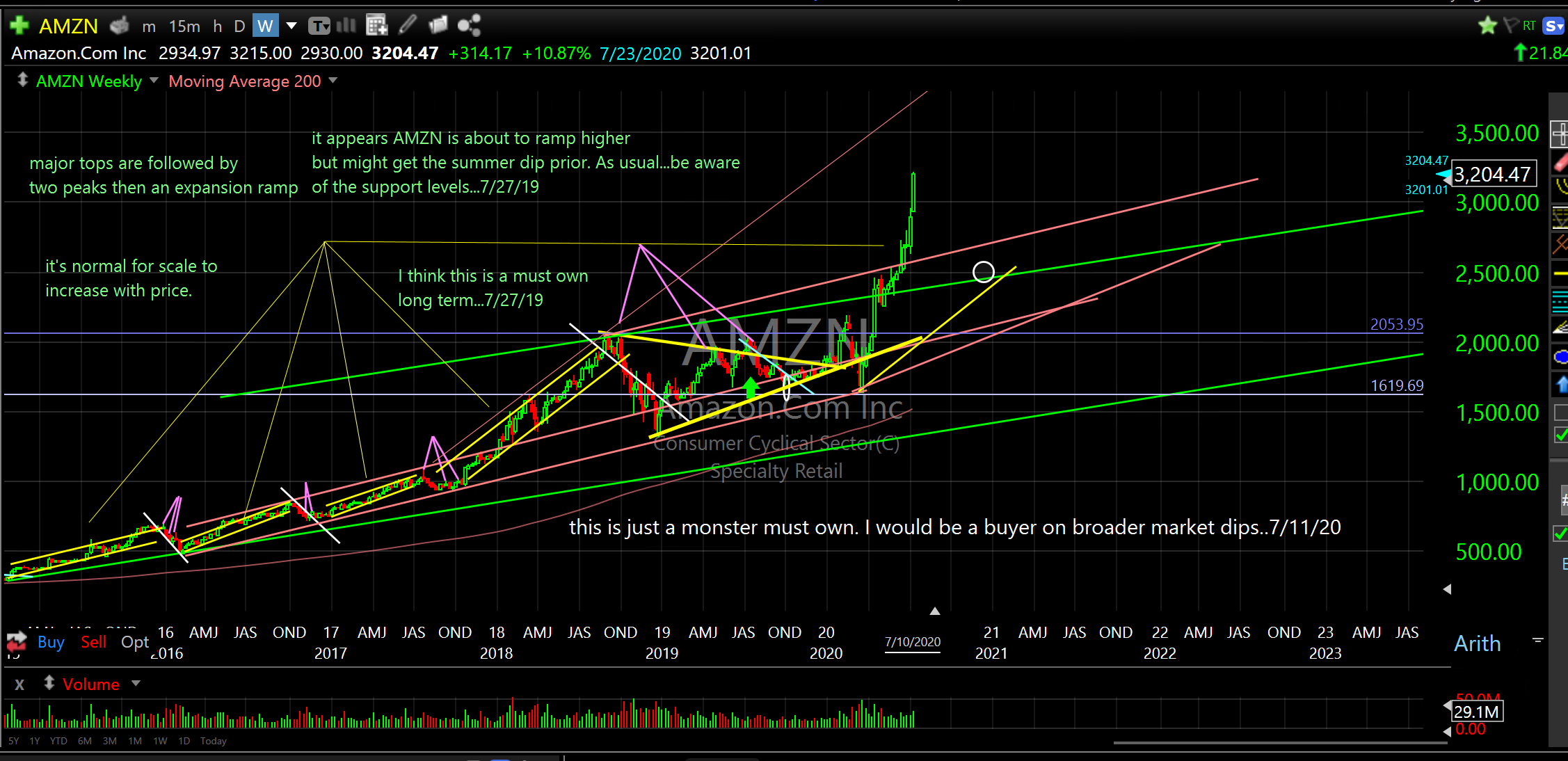

Nasdaq has just ripped higher from the Corona low and now it’s higher than it was prior to the collapse. The Dow and S&P 500 are following along like an old VW bus in a headwind (I know..I used to have one) since they are loaded with underperforming sectors unlike the tech heavy Nasdaq. Software companies (my long time favorites) are going through the moon and TSLA (see chart below for Entry Zone) has gone parabolic.

The markets are vulnerable here! I expect a rather deep technical correction any time between now and early August. I have been trimming on the way up and have gone from over 90% invested to about 75%. It’s hard mentally to sell when stocks are screaming higher but I’m willing to risk missing out on some gains by capturing some profits to be prepared for entries that could end up being home runs.

My shorter term forecast remains unchanged; increased volatility and chop through summer. There is certainly a chance for higher prices from here but I’m happy to reduce risk and Cache le Poudre (hide my powder)..the Cache le Poudre is a beautiful river that runs through Fort Collins, Colorado from high on Cameron Pass and where French trappers hid their gunpowder (Cache le Poudre). It is one of the most beautiful river canyons I have ever seen and I was lucky to experience its glory for 10 years living there. I think with all the madness in the world I could use a little Poudre time right now.

My longer term forecast is hopeful. I think if Trump stays in office the market will respond with higher prices. Biden is the wild card. With the Democratic party moving left faster than a one legged Hokey Pokey dancer, a Biden win could have the markets shaking all about.

Broader Market Entry and Exit forecasts:

Nasdaq

Dow

S&P 500

Individual Stocks

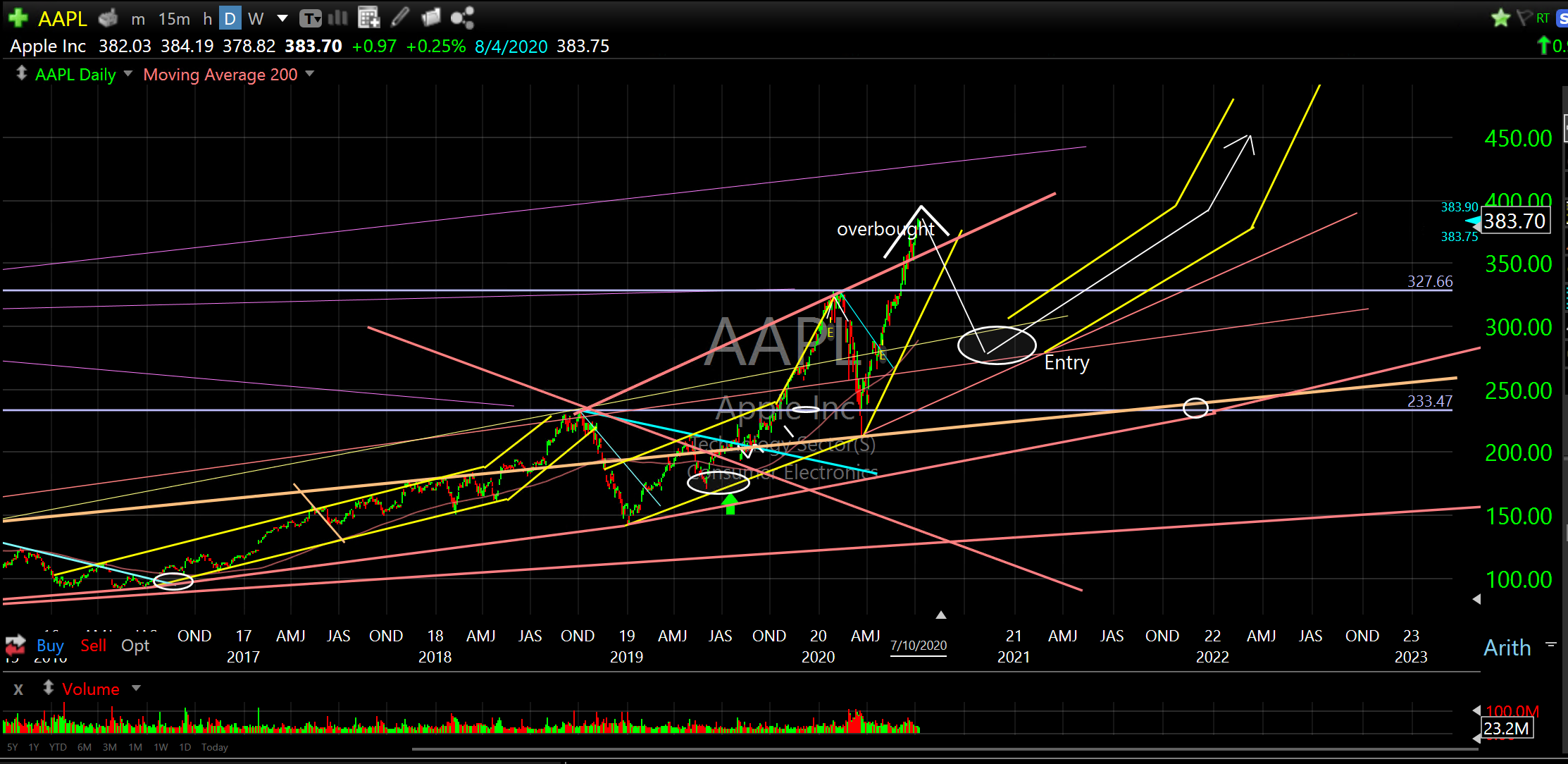

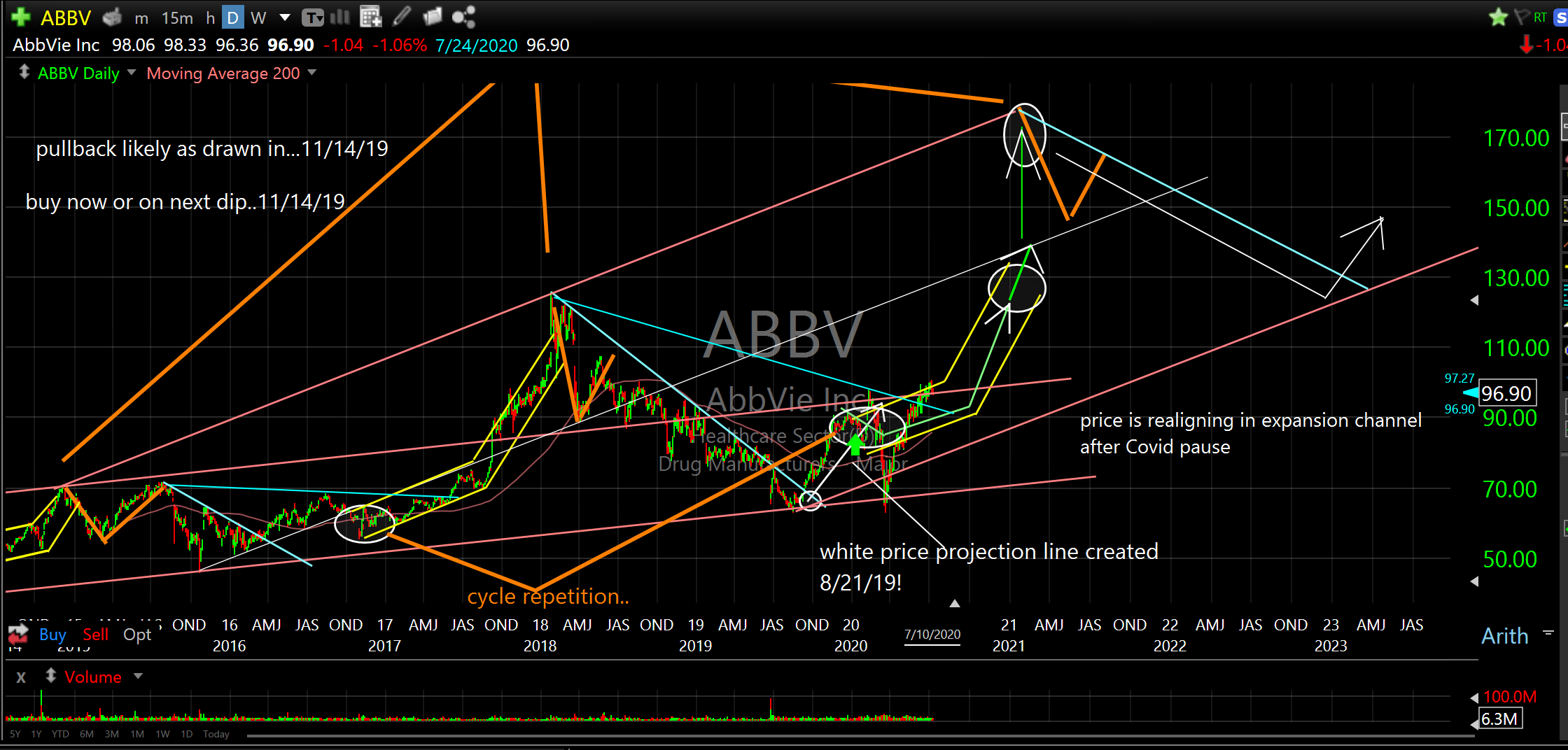

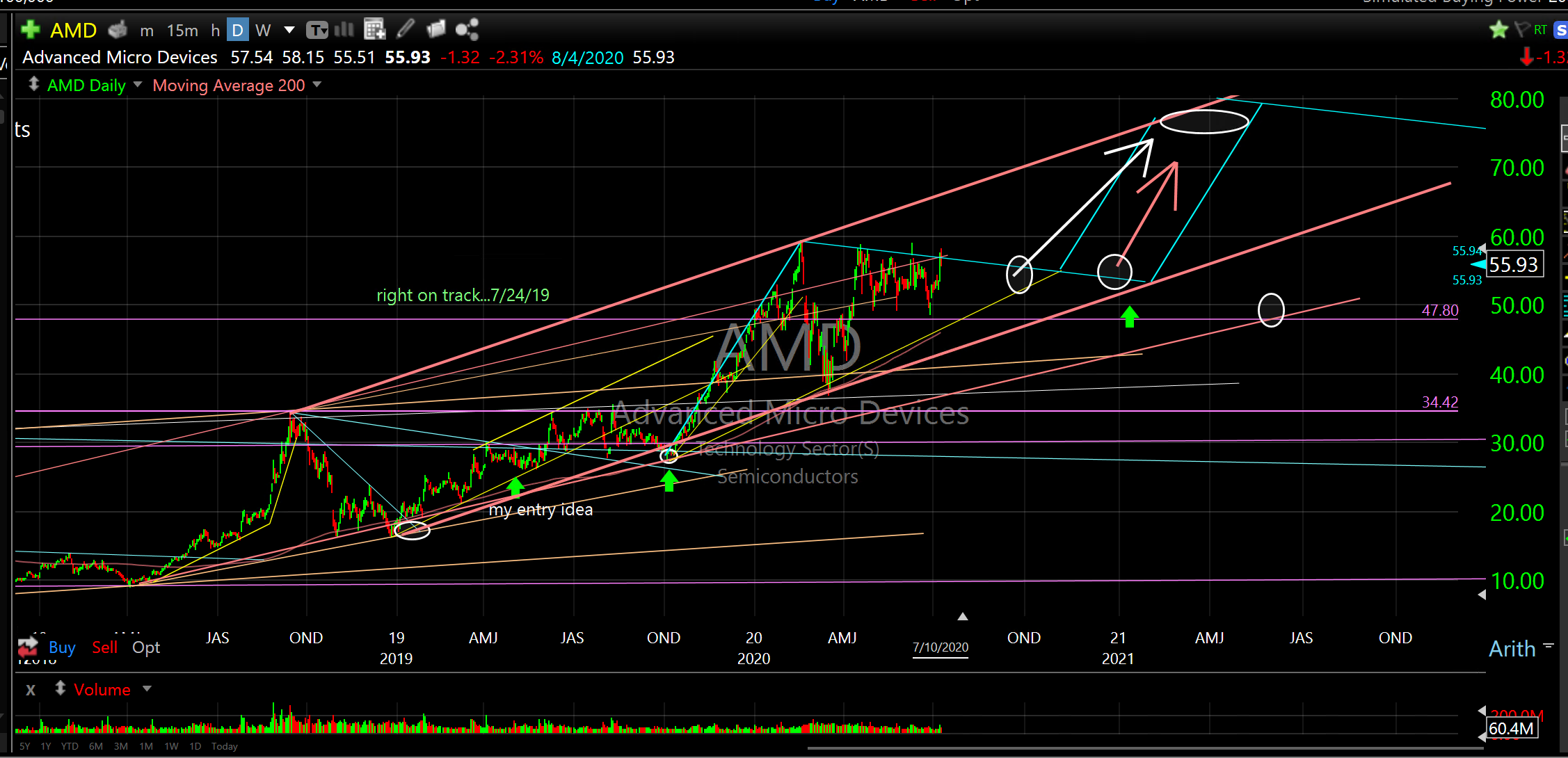

Over the next few weeks I will be publishing my favorite individual stocks. These are the stocks I expect to deliver the highest returns during the next leg up. These are the stocks that I expect to be positioned and aligned with the all important broader market reversal zones. Each chart will have my Entry and price track forecast.

My current forecast looks like the best Entries will occur during the September/October time frame which is not unusual on a seasonal basis, however, we must consider the uncertainty associated with the presidential election this year.

Put these stocks on your radar for now and I will be revisiting and commenting on them when they get down into their Entry Zones and align with the broader market reversal.

AAPL

ABBV

AMD

AMZN

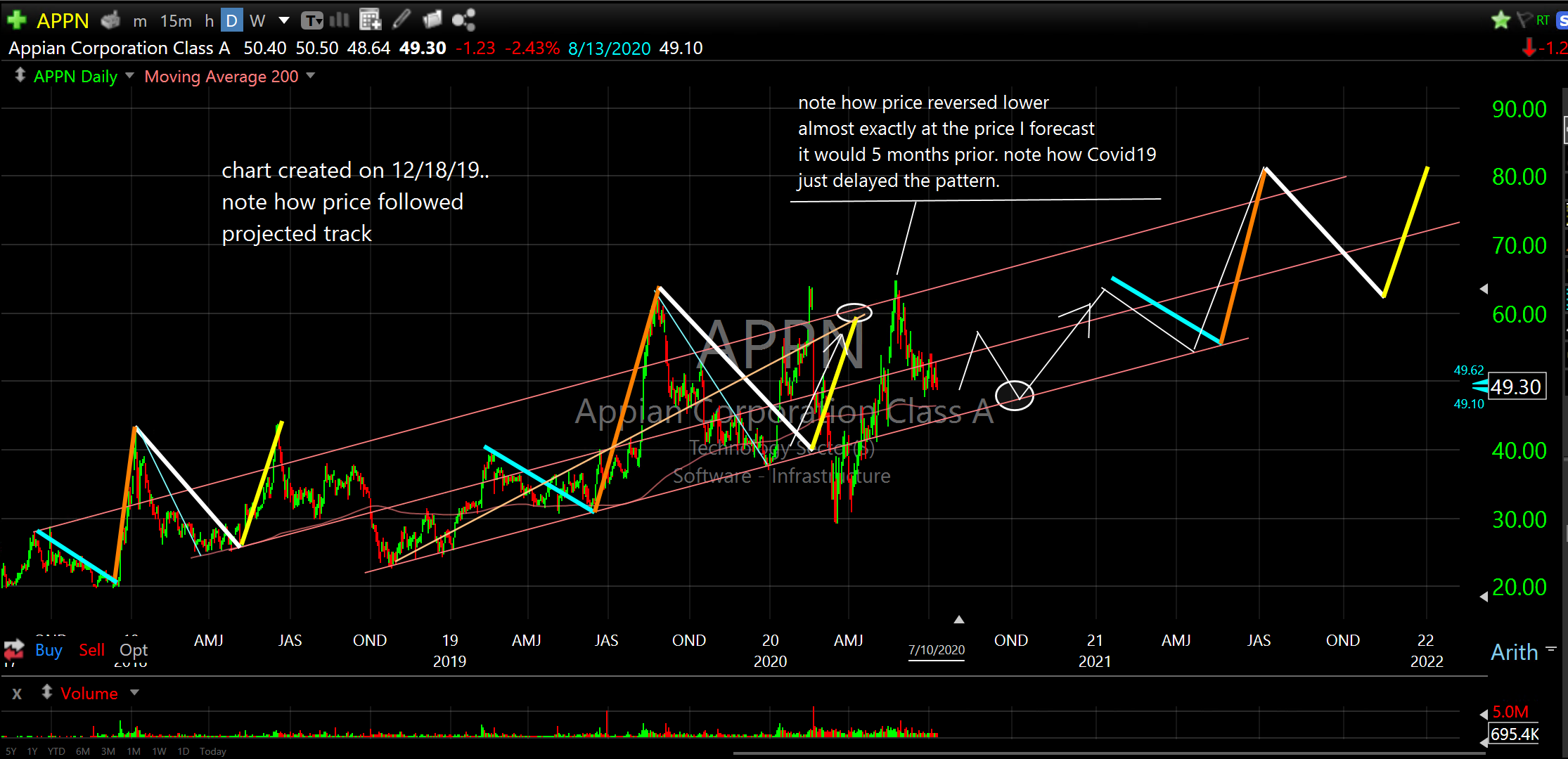

APPN

AYX

BABA

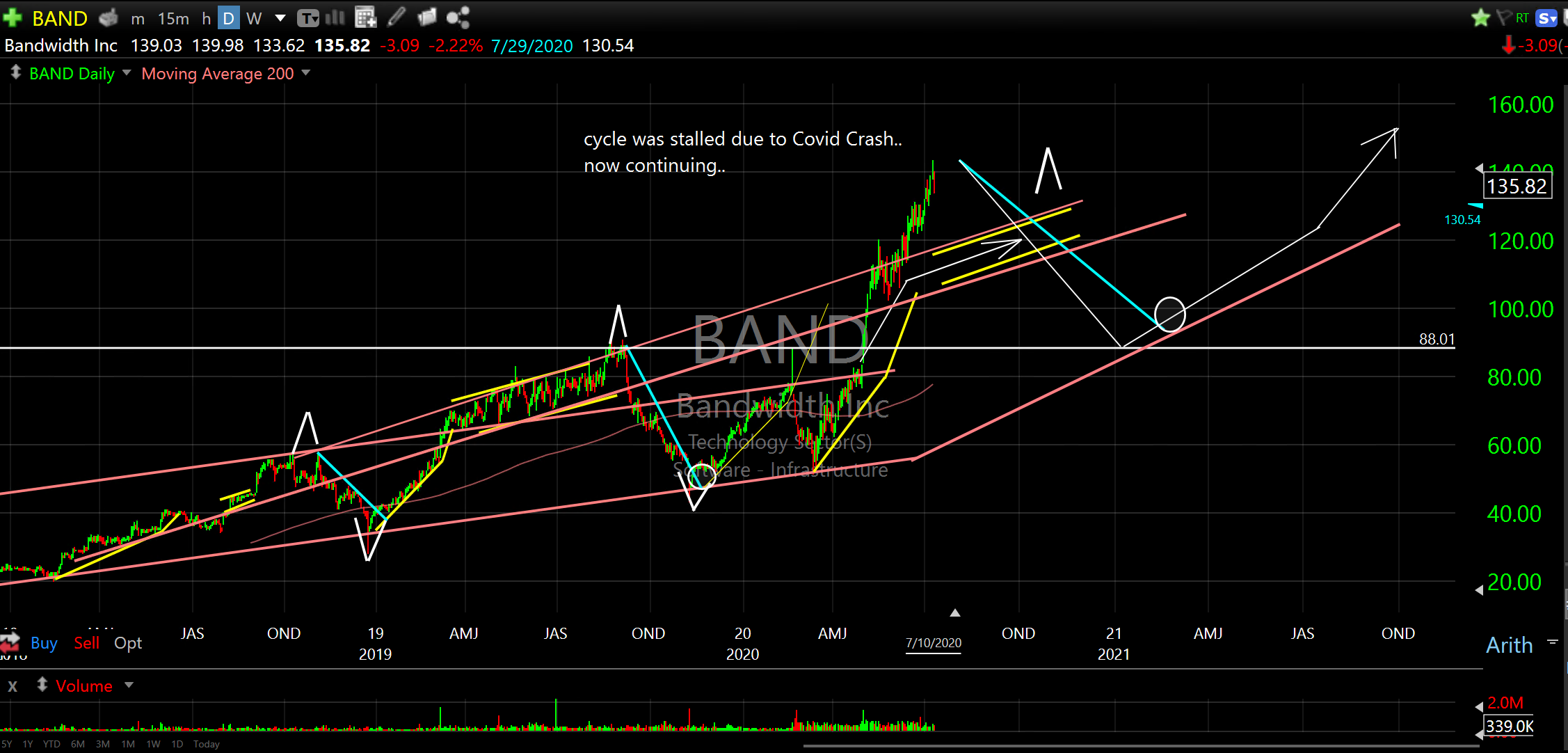

BAND

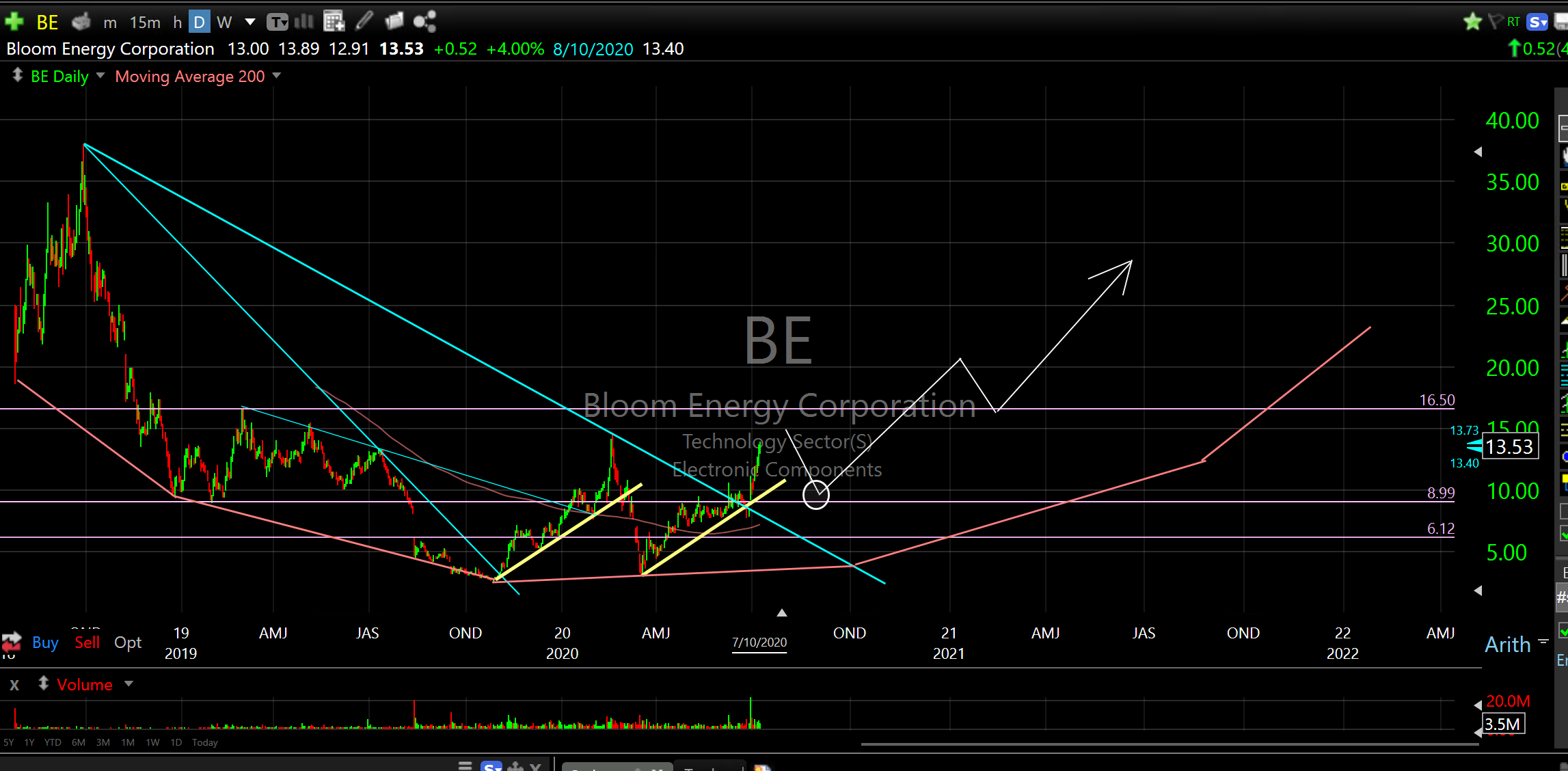

BE

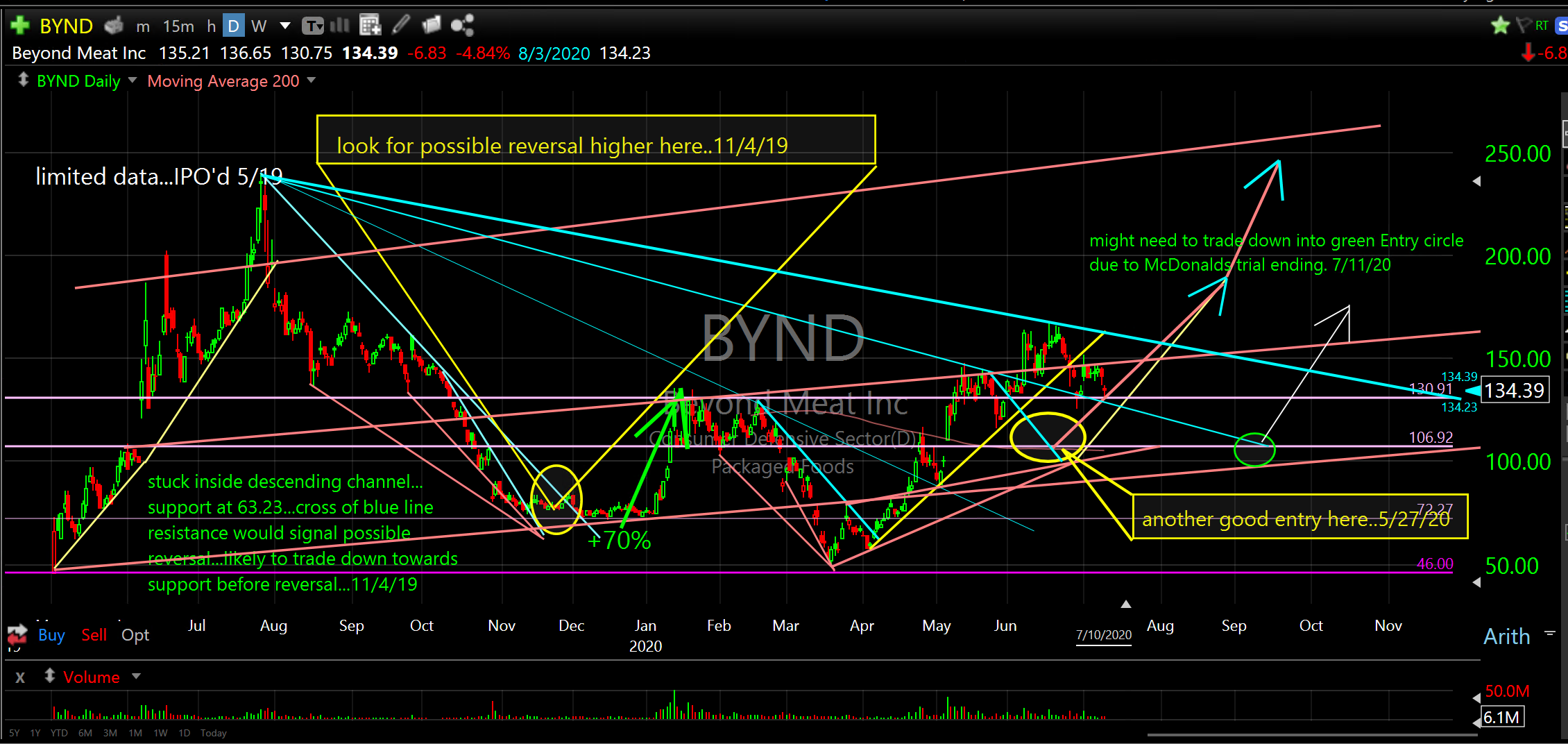

BYND

TSLA

Please review the charts in detail as that will help you understand each instrument’s unique pattern repetition cycle. Once the pattern is identified we can ascertain where it is in the pattern and make an accurate forecast in context with the current environment. In my decades of studying this stuff I have yet to find a better method of forecasting future prices.

Remain calm and do the Hokey Pokey,

Don